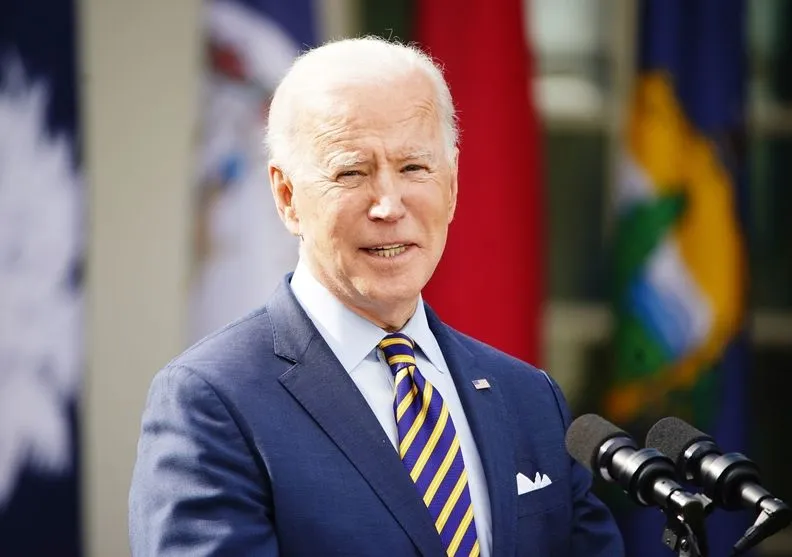

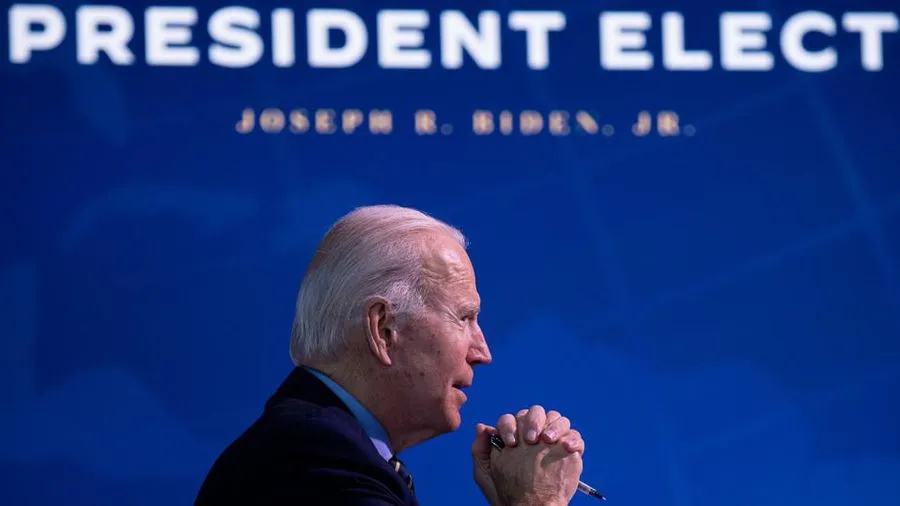

The proposal would tax long-term capital gains as ordinary income for taxpayers with taxable income above $1 million and raise the top marginal income tax rate to 39.6 percent.

Treasury Secretary Janet Yellen said U.S. inflation risks remain subdued as the Biden administration pumps $1.9 trillion in pandemic relief into the economy which should give anyone pause.

A projected switch in calculating retirement plan benefits from a deduction to a credit could have significant implications for high-net-worth taxpayers

“Overall, it’s not a negative thing to see rates rising. What’s spooked everyone is how fast it’s moved.”

If you’re a renter wondering whether it’s time to buy a home, there’s a lot to consider. It’s not always an easy decision.

First major federal tax hike since 1993 to help pay for the long-term economic program designed as a follow-up to his pandemic-relief bill.

President Joe Biden’s commerce secretary nominee, Gina Raimondo, signaled to lawmakers Tuesday that she is open to hiking taxes on the middle class to raise funds to fight climate change.

With control of both the House and Senate in Democratic hands, President Biden will be able to get more of his tax policy proposals through Congress. Here's what could happen in the next four years.

And although his tax plan will impact the bottom line of the wealthiest of Americans, low- and middle-income households may benefit from increased tax credits.