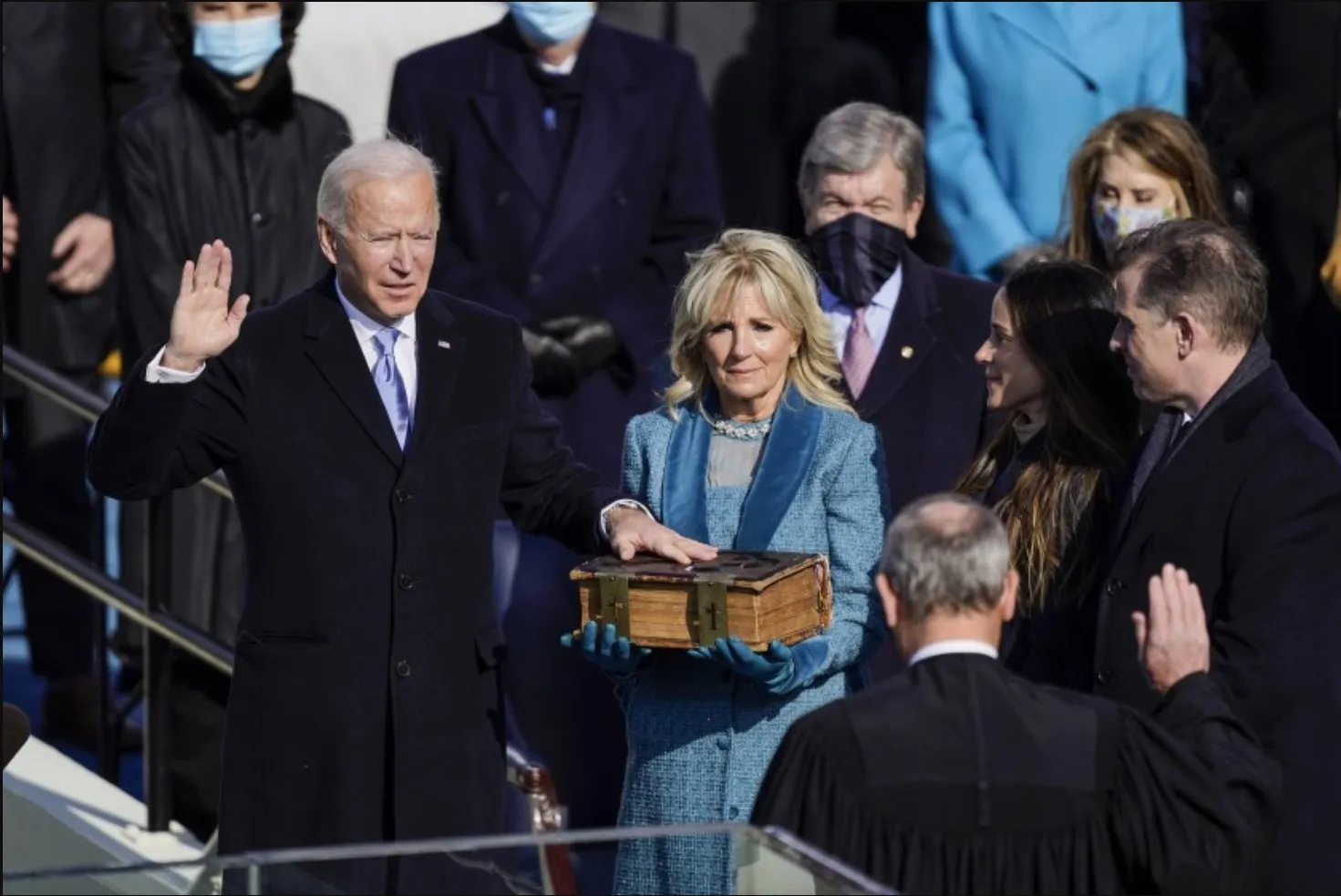

What corporate tax departments can expect from Biden’s tax policies in 2021 and beyond

As U.S. National Tax Department Leader at Ernst & Young, Michael Mundaca has an insider’s perspective on the path ahead for tax agenda being put forth by the new administration of President Joseph Biden

biden

Be Ready for Big Changes: 2021 Tax Planning

Some fear that these tax increases will be retroactive to January 1, 2021, which is certainly possible.

biden

What Changes You Could See Under Biden’s Tax Plans

You may be wondering how potential tax changes might affect you as we enter the new year. Here are some important things to consider regarding Biden’s tax plans.

Financial Health

How Will Federal Reserve Rate Changes Impact Tax Planning?

Financial Health

Apply 20/20 Hindsight Profitably Through Tax Planning

Financial Health

Act Like a Big Business – Use Proactive Tax Planning

Tax Benefits

Sell Assets – Defer the Taxes

Financial Health

Crime Does Not Pay – Save on Taxes the Legal Way

Financial Health

Businessman Sells Company – Keeps Taxes in His Pocket for Years

Estate Planning

IRS Seeks to Limit Minority-Interest Estate Tax Moves

Let's Talk!

Informed Tax Strategies for Success

Thanks for stopping by! We're here to help, please don't hesitate to reach out.